PAN-AADHAAR Linking

By: Mr. Mohit Shetty - 2nd June, 2022

Section 139AA of the Income Tax Act states that every person who has been allotted and who is eligible to obtain Aadhaar number shall link his PAN with Aadhaar.

There are certain individuals who meet certain conditions are not mandated to link PAN-AADHAAR. Conditions being if an individual is:

- A resident of the state/Union Territory of Assam, Jammu and Kashmir and Meghalaya.

- A non-resident as defined in Income Tax Act 1961.

- 80 years or more.

- Not a citizen of India.

Section 234H was inserted into the Finance Act of 2021 for levying late fees on the persons who are responsible to obtain and link PAN with Aadhaar number but who failed to do so. The recent deadline for linking the PAN with Aadhaar was 31st March, 2022, after numerous extensions.

As per CBDT circular dated 30th, March 2022 taxpayers now have been given time till 31st March, 2023 to link their PAN with Aadhaar with a nominal amount of fee. Taxpayers will be required to pay a fee of Rs. 500 from 1st April, 2022 till 30th June, 2022 and a fee of Rs. 1,000 thereafter till 31st March, 2023. Once the payment is made you can input the challan details and get the linking process completed.

You can link your PAN with Aadhaar by following process:

-

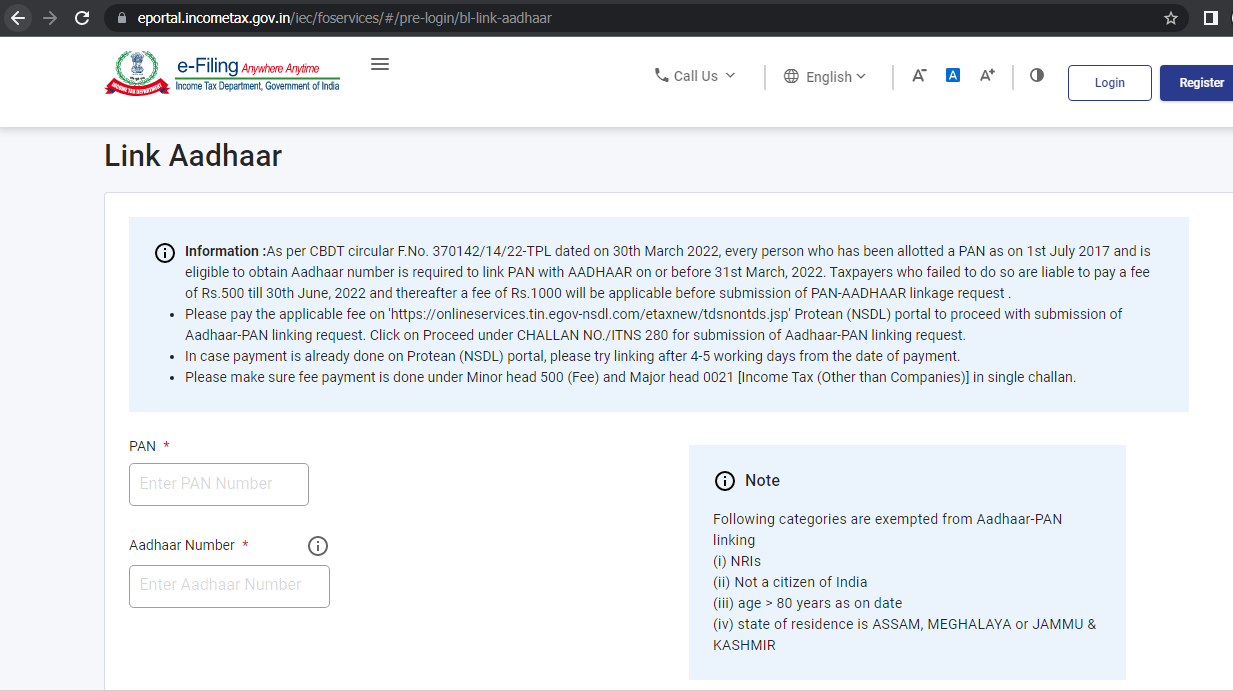

Open the Income Tax e-filing portal https://www.incometax.gov.in/iec/foportal. Go on the Quick links Tab seen on the left hand side of your screen and click “Link Aadhar” option to link your PAN and Aadhaar. Screenshot of the page how it is seen after clicking is attached below:

-

The Penalty fee of Rs. 500 or Rs. 1000 must be paid through NSDL site https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp. Click on proceed under CHALLAN NO./ITNS 280 for submission of Aadhaar-PAN linking request.

-

Please make sure fee payment is done under Minor head 500 (Other Receipts), Major head 0021 [Income Tax (Other than Companies)] and A. Y as 2023-24 in single challan. The payment made at NSDL site takes weeks’ time to update the challan. It is advisable to try to link after a week.

-

Make sure you're paying the fee under the headings listed above. If you don't pay the fee under the headings listed above, then there is no refund provision to claim the money back.

-

If there is PAN Aadhaar mismatch in name/mobile no/DOB etc than correct your details on

For PAN https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

For Aadhaar https://uidai.gov.in/my-aadhaar/update-aadhaar.html

OR

By visiting physically in respective centre where the facility to update is available.

If you don’t link your PAN and Aadhaar till the stipulated extended period of time of 31st March, 2023 than your PAN will become in-operative and it will be treated as invalid as per the Income Tax Act.

Note: The above conditions are subject to change as and when notified by the Authority from time to time.

Disclaimer

The Blogs published in this website are for educational purposes only. It is meant to give you a general information and a general understanding of the topics discussed therein and not to provide you or any person any professional advice thereof. By using this website you understand that there is no professional relationship between you and Mundle Venkatraman and Associates (MVA) or with any of its partners, associates or employees. Any information available on this website should not be used as a substitute for competent professional advice.

Terms of UseRecent Blogs

Union Budget 2025 – A synopsis about the tax and compliance reforms

By: Priyanka Jain

6th February, 2025

Income Tax Clearance Certificate for travel outside India

27th August, 2024

By: Vidhi Vora

28th March, 2023

By: Mr. Prasanna Ravikant Bhat

7th February, 2023

Certificate in Form 10BE for Claiming Deduction u/s 80G

By: Mr. Prasanna Ravikant Bhat

27th May, 2022

Profession tax enrollment and registration - Applicability in Maharashtra State

By: Mr. Prasanna Ravikant Bhat

19th March, 2021

Foreign Contribution (Regulation) Amendment Act, 2020 ("FCRA 2020")

By: Nikita Theresa Noronha

16th December, 2020

Using file systems to enhance performance of Income Tax Business Application (ITBA)

17th December, 2019

Income Tax Compounding Fees - 276CC Offences - Nonfiling of returns

13th November, 2019

American Institute of Certified Public Accountants

American Institute of Certified Public Accountants  Association of Chartered Certified Accountants

Association of Chartered Certified Accountants  Chartered Institute of Management Accountants

Chartered Institute of Management Accountants  Federal Reserve Board of USA

Federal Reserve Board of USA  Indian GST FAQs

Indian GST FAQs  Indian Income Tax

Indian Income Tax  Information System Audit and Control Association

Information System Audit and Control Association  Institute of Chartered Accountants of England and Wales

Institute of Chartered Accountants of England and Wales