Using file systems to enhance performance of Income Tax Business Application (ITBA)

By: Mr. Deepak Gupta - 17th December, 2019

Issue of slow down of ITBA and problem of attaching large files

- When files are uploaded by assessee in the ITBA it is stored in the ITBA database with limitations on number and size of files uploaded.

- This can cause slow down of the system with the ever increasing user base and the volume of files uploaded in the ITBA database.

- Apart from bad user experience there is a genuine difficulty in attaching large files. This can be overcome by using a separate file server to store uploaded files and providing the link of the stored location in the ITBA database.

Suggested Solution

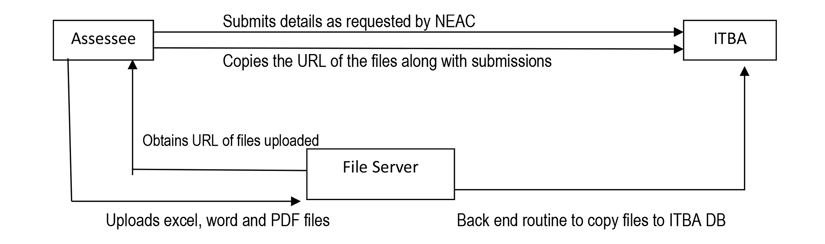

- The IT authorities create a dedicated and secured file repository system like a digital locker to store all file uploaded by the assessees.

- The assessees get user login in this file system along with the access to ITBA preferably by a single sign on.

- The files that the assessee wants to submit are uploaded by him on this server and its URL is provided in ITBA web form (No attachment only URL).

- To further improve the security and cohesiveness of these systems the files from the file systems can be copied to database by a backend routine which can be scheduled to run at night time when usage is low

- This way the performance of ITBA is enhanced, the issue of uploading large files is resolved and concern of loose coupling of the two systems is also addressed.

Disclaimer

The Blogs published in this website are for educational purposes only. It is meant to give you a general information and a general understanding of the topics discussed therein and not to provide you or any person any professional advice thereof. By using this website you understand that there is no professional relationship between you and Mundle Venkatraman and Associates (MVA) or with any of its partners, associates or employees. Any information available on this website should not be used as a substitute for competent professional advice.

Terms of UseRecent Blogs

Union Budget 2025 – A synopsis about the tax and compliance reforms

By: Priyanka Jain

6th February, 2025

Income Tax Clearance Certificate for travel outside India

27th August, 2024

By: Vidhi Vora

28th March, 2023

By: Mr. Prasanna Ravikant Bhat

7th February, 2023

Certificate in Form 10BE for Claiming Deduction u/s 80G

By: Mr. Prasanna Ravikant Bhat

27th May, 2022

Profession tax enrollment and registration - Applicability in Maharashtra State

By: Mr. Prasanna Ravikant Bhat

19th March, 2021

Foreign Contribution (Regulation) Amendment Act, 2020 ("FCRA 2020")

By: Nikita Theresa Noronha

16th December, 2020

Income Tax Compounding Fees - 276CC Offences - Nonfiling of returns

13th November, 2019

American Institute of Certified Public Accountants

American Institute of Certified Public Accountants  Association of Chartered Certified Accountants

Association of Chartered Certified Accountants  Chartered Institute of Management Accountants

Chartered Institute of Management Accountants  Federal Reserve Board of USA

Federal Reserve Board of USA  Indian GST FAQs

Indian GST FAQs  Indian Income Tax

Indian Income Tax  Information System Audit and Control Association

Information System Audit and Control Association  Institute of Chartered Accountants of England and Wales

Institute of Chartered Accountants of England and Wales