Annual Information Statement (AIS)

By: Mr. Prasanna Ravikant Bhat - 22nd November, 2021

As intimated by the Hon. Finance Minister of India in her Union Budget, the CBDT has launched the AIS portal on 1st November, 2021 which gives a comprehensive and detailed statement containing details of many of the financial transactions undertaken by an assessee in the financial year (FY). It is an “All-in-one statement”.

The statement contains all information that is specified/notified under the Income-tax Act, 1961 and which is uploaded by the entities/institutions who are required to report such transactions under section 285BA via Rule 114E.

The statement contains information related to income earned/accrued from various sources such as salary, dividend, interest from savings account, fixed and recurring deposits, sales/redemptions/switch in-out and purchase of equity shares, bonds, mutual funds etc.

The statement also contains information related to TDS, Advance taxes paid, Self Assessment tax paid, TCS and any tax demand or refund, and allied information.

Let us now see steps to download AIS from Income tax portal

Step 1: Login into your account on e-filing portal at www.incometax.gov.in.

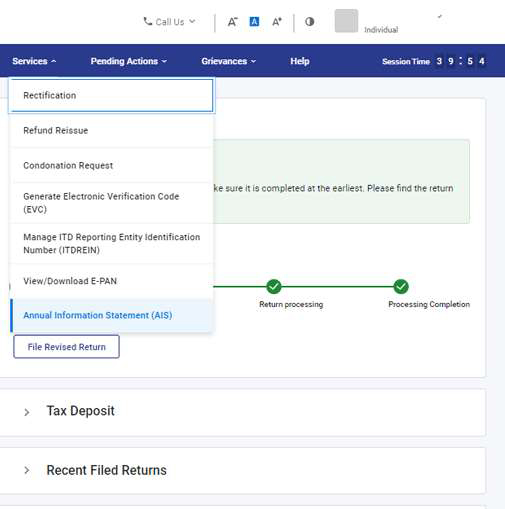

Step 2: Click on the 'Services' tab, select 'Annual Information Statement (AIS)'. A pop-up will appear on your screen. Click on 'Proceed'. You will be taken to another website i.e AIS portal

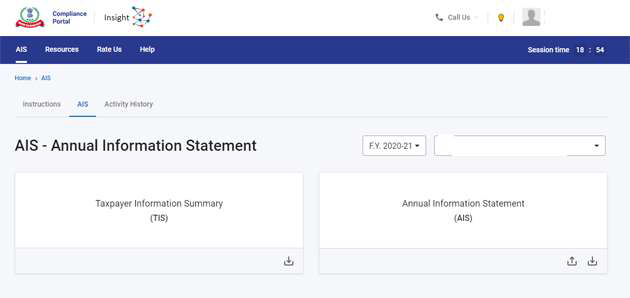

Step 3: On opening the web page click on 'AIS' tab. You will have to select either of the two options: Taxpayer Information Summary (TIS) or Annual Information Statement (AIS).

-

Annual Information Statement (AIS) provides comprehensive information of a taxpayer as displayed in Form 26AS. Taxpayer can even provide feedback on such information displayed in AIS. AIS shows both reported value and modified value (i.e. value after considering taxpayer feedback) under each section (i.e. TDS, SFT, Other information). The functionalities under AIS Tab are:

-

View Annual Information Statement

-

Submit Feedback on AIS

-

Upload AIS feedback packet generated from AIS utility

-

Download Annual Information Statement (PDF/ JSON)

-

Download Specific Information Details (CSV)

-

Download AIS Consolidated Feedback (PDF)

-

Download AIS Feedback Acknowledgement (PDF)

-

Download AIS Feedback Tracker (PDF)

-

-

Taxpayer Information Summary (TIS) is information which is an aggregated summary category-wise for a taxpayer. It shows processed value (i.e. value generated after deduplication of information based on pre-defined rules) and derived value (i.e. value derived after considering the taxpayer feedback and processed value) under each information category (e.g. Salaries, Interest, Dividend etc.). The derived information in TIS will be used for prefilling of return, if applicable. The functionalities under TIS Tab are:

-

View Taxpayer Information Summary

-

Download Taxpayer Information Summary (PDF/ JSON) AIS data can also be accessed using the AIS Utility.

-

This utility can be downloaded through the 'Utility' tab under 'Resources' section.

-

Before installing the new version of AIS Utility on your system, please uninstall the previous version.

-

For more details on AIS functionalities, please refer AIS documents (User Guides, FAQs and AIS Handbook) provided in "Resources" section.

All PDF documents downloaded are password protected. The password to open the PDFs is a combination of PAN (in CAPS) and date of birth (in DDMMYYYY format) e.g., if the PAN is CCCCC0000C and date of birth is February 10, 1976, the password to open the PDF will be CCCCC0000C10021976.

It will also show the financial year for which AIS is being downloaded, taxpayer PAN and name. As of now only information pertaining to FY 2020-21 is available for downloading.

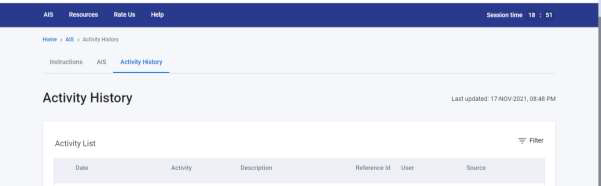

Download has a history tab which provides detailed information of log ins, AIS statements downloaded, along-with date, time, description of download and IP Address.

Features of AIS:

AIS is divided into two parts: Part A and Part B.

Part A contains general information such as PAN, masked Aadhaar number, name of taxpayer, date of birth etc.

Part B contains comprehensive information of TDS, TCS, Specified Financial Transactions, payment of taxes, tax demand and refund and other information.

Point to be noted is that AIS also includes details/information that are not part of Form 26AS.

Error Checking:

The income tax department in its press release, has asked the taxpayers to check the information available in the AIS. If there is a mismatch in the information, then taxpayers should inform the same to the income tax department. If the mismatch is not informed to the tax department, then it may be assumed that the information reflected in AIS is correct and the income tax department may ask you to explain the mismatch between the income tax return filed by you and the information in the AIS.

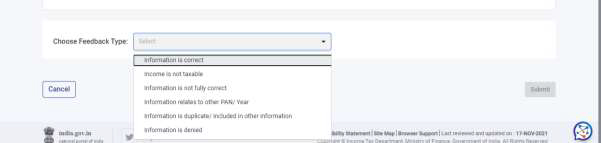

"If the taxpayer feels that the information is incorrect, relates to other person/year, duplicate etc., a facility has been provided to submit online feedback,"

Advantages:

-

Provides comprehensive and in-depth detailed statement.

-

If statement figures and figures mentioned in return don't match then there is an option provided to give feedback regarding the difference/s.

-

Every-time one accesses the portal, a notification regarding the login is sent to the registered email-id and mobile no. This will highlight unauthorized access, if any.

Disadvantages:

-

Statement can change after the income tax return has been filed.

-

Even after giving feedback there are chances that department might ask for more information regarding the feedback given.

In the larger perspective, the AIS will prove to be a boon to taxpayers as well as tax consultants as it will provide relevant information in one place basis which the computation of income can be prepared. Going forward, am sure the AIS will include information from other sources also to make it even more comprehensive.

Disclaimer

The Blogs published in this website are for educational purposes only. It is meant to give you a general information and a general understanding of the topics discussed therein and not to provide you or any person any professional advice thereof. By using this website you understand that there is no professional relationship between you and Mundle Venkatraman and Associates (MVA) or with any of its partners, associates or employees. Any information available on this website should not be used as a substitute for competent professional advice.

Terms of UseRecent Blogs

Union Budget 2025 – A synopsis about the tax and compliance reforms

By: Priyanka Jain

6th February, 2025

Income Tax Clearance Certificate for travel outside India

27th August, 2024

By: Vidhi Vora

28th March, 2023

By: Mr. Prasanna Ravikant Bhat

7th February, 2023

Certificate in Form 10BE for Claiming Deduction u/s 80G

By: Mr. Prasanna Ravikant Bhat

27th May, 2022

Profession tax enrollment and registration - Applicability in Maharashtra State

By: Mr. Prasanna Ravikant Bhat

19th March, 2021

Foreign Contribution (Regulation) Amendment Act, 2020 ("FCRA 2020")

By: Nikita Theresa Noronha

16th December, 2020

Using file systems to enhance performance of Income Tax Business Application (ITBA)

17th December, 2019

Income Tax Compounding Fees - 276CC Offences - Nonfiling of returns

13th November, 2019

American Institute of Certified Public Accountants

American Institute of Certified Public Accountants  Association of Chartered Certified Accountants

Association of Chartered Certified Accountants  Chartered Institute of Management Accountants

Chartered Institute of Management Accountants  Federal Reserve Board of USA

Federal Reserve Board of USA  Indian GST FAQs

Indian GST FAQs  Indian Income Tax

Indian Income Tax  Information System Audit and Control Association

Information System Audit and Control Association  Institute of Chartered Accountants of England and Wales

Institute of Chartered Accountants of England and Wales