Reporting Requirements u/r 21AAA of the Income Tax Rules by Resident Indians who have retirement benefit accounts overseas.

By: Vidhi Vora - 28th March, 2023

Intention of law maker: Why this Rule?

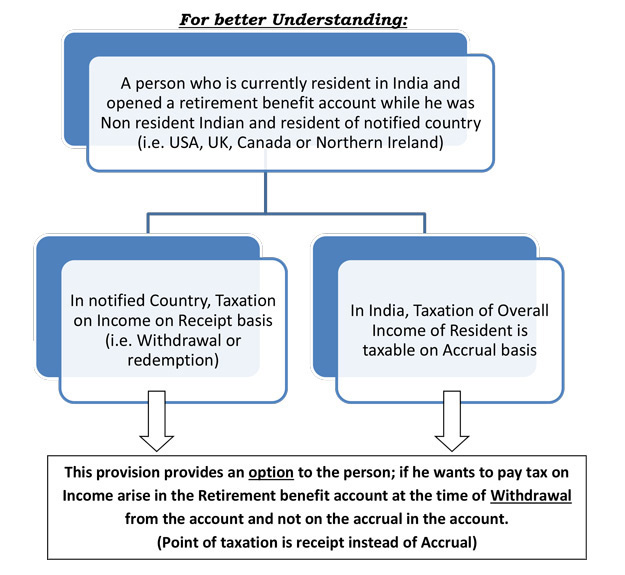

There are many Indians (“specified persons”) who are currently resident in India for income tax purposes but who were non-resident in India in the past when they were working abroad and, therefore, have retirement benefit accounts in those countries (“specified accounts”) e.g. 401k accounts.

The tax codes of the foreign countries (“notified countries”) provide for taxing of annual accruals on such retirement benefit accounts only in the year of withdrawal.

The Indian Income Tax Act, however, requires these taxpayers (who are resident in India) to pay tax on their global incomes which include the accruals to their overseas retirement benefit accounts.

This deferral of tax on the accruals to overseas retirement benefit accounts to the year of withdrawal while at the same time attracting tax in India on a year to year basis creates a dichotomous situation and puts the Indian taxpayer to severe disadvantage.

One is the cash flow issue of having to pay income tax in India every year for accruals overseas as he does not receive any cash; and

Secondly, he won’t be able to avail of the double tax credit on income tax paid on withdrawals in the foreign country as he has already paid tax on the accruals over the years in India.

This Rule provides an option the Specified person to remove the hardships as mentioned above. By availing the option provided by this Rule the taxpayer is allowed to defer the amount of accruals on their overseas retirement benefit accounts and make it taxable in India in the year of withdrawal of such benefits so that the year of taxation in both countries is the same. This would enable the taxpayer to claim the double tax credit for the taxes paid overseas as well as make payment of taxes in India easy as the taxpayer would then have the cash available to pay such taxes.

How they Introduced the provision?

Section 89A was Introduced in the Union budget and consequently vide Income-Tax (6th Amendment), Rules 2022, Rule 21AAA was introduced w.e.f. AY 2022-23. And for the purpose of implementation Form 10-EE was formulated and introduced.

Explanation to Section 89A states:

-

“notified country” means a country as may be notified by the Central Government. Presently, the Central Government has notifed the following countries:

-

USA

-

UK and Northern Ireland

-

Canada

-

-

“specified account” means an account maintained in a notified country by the specified person in respect of his retirement benefits and the income from such account is not taxable on accrual basis but is taxed by such country at the time of withdrawal or redemption

-

“specified person” means a person resident in India who opened a specified account in a notified country while being a non-resident in India and resident in that country.

Important Points: (According to Rule 21AAA)

-

It shall be exercised for ALL the specified accounts maintained.

-

If the resident person becomes Non- resident in the relevant previous year then, it shall be deemed that this option is not exercised by that person and accordingly the relief that was granted to him shall be withdrawn and taxed in the previous year immediately preceding the previous year in which he becomes a non-resident.

-

To exercise this option, a person needs to file Form 10-EE electronically before due date prescribed in section 139(1), duly signed by DSC or EVC.

-

Once this option is exercised it cannot be withdrawn.

Actual Implementation – Procedural Requirements:

Form 10EE needs to be filed before due date prescribed in section 139(1). Information and Documents required in Form – 10EE:

-

Name, Address, PAN and PY in which option is exercised.

-

Details of all Specified accounts:

-

How that Income is taxable.

-

Previous Year in which such Income is eligible for Withdrawal from specified account.

-

Nature of Income.

-

Income already taxed on accrual basis in earlier years.

-

Specify those earlier years.

-

Income not taxable in India due to DTAA or person being Non–Resident.

-

Specify those years in which such Income is not taxable.

-

If ROI is furnished, then provide acknowledgement no.

-

-

Whether person wants to exercise this option or not.

-

Declaration.

-

Evidential Documents to be provided:

-

Copy of Statement of Specified account.

-

How the Income from specified account has been taxed or taxable in notified country (provision levied in that country to tax such Income)c.

-

Computation of Income for all the previous years, where Income is already included the total Income on accrual basis.

-

Reconciliation of such Computation of Income with Return of Income.

-

-

Disclaimer

The Blogs published in this website are for educational purposes only. It is meant to give you a general information and a general understanding of the topics discussed therein and not to provide you or any person any professional advice thereof. By using this website you understand that there is no professional relationship between you and Mundle Venkatraman and Associates (MVA) or with any of its partners, associates or employees. Any information available on this website should not be used as a substitute for competent professional advice.

Terms of Use American Institute of Certified Public Accountants

American Institute of Certified Public Accountants  Association of Chartered Certified Accountants

Association of Chartered Certified Accountants  Chartered Institute of Management Accountants

Chartered Institute of Management Accountants  Federal Reserve Board of USA

Federal Reserve Board of USA  Indian GST FAQs

Indian GST FAQs  Indian Income Tax

Indian Income Tax  Information System Audit and Control Association

Information System Audit and Control Association  Institute of Chartered Accountants of England and Wales

Institute of Chartered Accountants of England and Wales